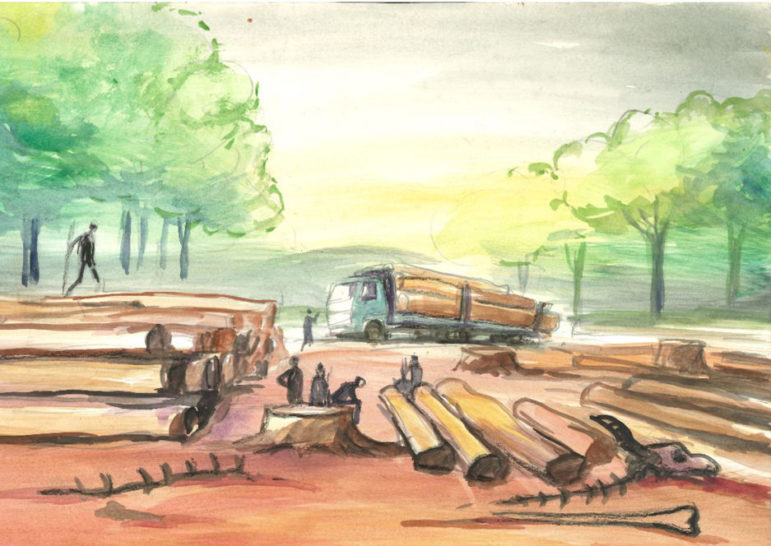

Illustration: Dominique Mkamkumi for GIJN

Guide to Investigating Organized Crime in Africa: Chapter 5 — Natural Resources Theft

Read this article in

Guide Resource

Guide to Investigating Organized Crime in Africa

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa — Introduction

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 1 — Environmental Crimes

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 2 — Terrorist and Militia Groups

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 3 — Crimes on the Oceans

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 4 — Arms Trafficking

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 5 — Natural Resources Theft

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 6 — Drug Trafficking

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 7 — Financial Crimes

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 8 — Kleptocracies

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 9 — Other Crimes

Development experts refer to the many conflicts over control of extractives as the “resource curse.” To cite but one example of this, in Nigeria, more than one million people were massacred or starved to death during the Biafran war of secession between 1967 and 1970. At stake was control of the region’s large oil reserves, which made Nigeria Africa’s leading oil producer. In recent years, however, Nigeria has seen its production fall due to insecurity in the oil-rich region.

In Sierra Leone, the horrific civil war at the end of the last century was described by the French Le Monde Diplomatique as “a merciless struggle by international mining companies for control of the Sierra Leone diamond.” More than 120,000 people lost their lives.

In the eastern region of the Democratic Republic of Congo, looting and trafficking of extractive material have fueled endless conflicts for decades. The fighting is still ongoing, and the population remains in the grip of extreme poverty.

African countries hold 30% of the world’s oil, gas and mineral reserves, according to the NRGI. But the misuse of these resources compromises the socioeconomic development of the producing countries.

The United Nations Conference on Trade and Development (UNCTAD) reports that Nigeria lost an estimated US$69.8 billion in revenue due to under-invoicing of oil exports to the United States between 1996 and 2014. This is equivalent to one quarter of Nigeria’s total exports to the US. “Deep and institutionalized corruption in the oil sector” continues to this day, one study concluded.

Given the extraordinary suffering, rampant corruption, and inequitable development fueled by plundering these resources, there are few more important stories for journalists in Africa to report on. Here are some ways to investigate.

Tips and Tools

The extractives industry is big business for many African countries, as many of their economies depend on the exploitation of natural resources. Investigate how much is made from the business, how much is taxed and therefore left for the local communities, and the conditions in which the locals live.

When investigating extractive resources, make sure to examine the complex financial arrangements established by multinational companies. A 2015 report by the UN’s Economic Commission for Africa (ECA) and the African Union (AU) estimated that, during the past 50 years, Africa has lost more than US$1 trillion to illicit financial flows (IFF). This figure is equal to all official development assistance received by Africa during the same period. This high-level looting comes from corporate commercial activities (65%), criminal activities (30%), and corruption (5%). In this, the extractive sector plays a key role. According to the Organisation for Economic Cooperation and Development (OECD), roughly one-fifth of all corruption cases occur in the extractive sector and take the form of bribes paid to public officials.

Another area to investigate is the illicit, international trade between states, which is estimated to cost Africa a staggering US$288 billion per year, according to a 2020 report by Global Financial Integrity (GFI). This activity includes the falsification of invoices by companies to under- or over-value goods in order to pay the least amount of taxes possible. The extractive sector is at the forefront of interstate trade misinvoicing, GFI found, with misinvoicing of mineral fuels used by extractive companies estimated at US$113.2 billion between 2008 and 2017. GFI does a country-by-country analysis, so be sure to check the data for your region.

In 2021, Mali was the fourth largest producer of gold in Africa with 99 tons — right behind Burkina Faso (103 tons), South Africa (114 tons), and Ghana (129 tons). The sale of gold brought in revenues of US$2.5 billion, representing 77% of the country’s total export revenues. However, the sector’s contribution to government revenues is only 21%. This stark imbalance can be explained, in part, by the fact that extractive companies benefit from a 10% percentage point tax reduction compared to other companies. Perhaps not coincidentally, Mali ranks 184th out of 189 countries in the UN Human Development Index (HDI), which takes into account indicators of life expectancy, education, and per capita income.

Investigate the impact on local communities and the environment. Many extractive projects get away with inadequate environmental and social impact assessments, as was the case in Guinea. Read those assessments and ask for experts to help you understand the jargon.

What Can Journalists Investigate?

Investigate all stages of an extractive project: research, construction, exploitation, closure, and rehabilitation. More specifically, examine these questions:

- Do companies have authorization before starting exploration and exploitation activities? They often start without getting any permits. Check who is the legal owner of the land. There are cases where local communities and Indigenous people were ousted from their land.

- What is the level of corruption in order to obtain operating permits?

- In the negotiation of mining contracts, did the state require an appropriate tax rate?

- Do companies fairly compensate for the land and habitats of people displaced during a settlement?

- Do companies degrade the environment (by polluting the air and water, for example)?

- Are companies violating employee rights?

- Can the collection, management, and distribution of collected revenues be tracked? Are there outside audits and are they publicly available?

- Are corporate declarations of income and production accurate?

- Do the companies participate in creating local jobs? Are they sourcing products from within the country?

- Does the state monitor the sector sufficiently to detect shortcomings?

- Are mining contracts published?

- Are environmental and social impact studies conducted to minimize negative impacts?

- What happens when the project ends? Is there a post-closure rehabilitation fund? Examine whether the funds provided are enough.

- Are there conflicts of interest, with government officials or their families with financial stakes in the extractive sector?

- What is the extent of fraud and tax evasion in the extractive sector?

Where to Find Resources

Information on the extractive sector can be found in several sources, including:

- The Extractives Industries Transparency Initiative. EITI is a global initiative in which member countries commit to “disclose information along the extractive industry value chain — from how extraction rights are awarded, to how revenue make their way through government and how they benefit the public.” If the this revenue gap is not large, the country is considered to be more or less transparent in the management of the extractive sector. EITI reports can be a major source for finding data on the extractive sector in member countries.

- Look for data on Sedar, a Canadian website where users can access information about Canadian companies’ activities across the world, including Africa. This open source site aims to bring more transparency and responsibility to Canadian companies.

- The Kimberley Process is an international initiative that “unites administrations, civil societies, and industry in reducing the flow of conflict diamonds — ‘rough diamonds used to finance wars against governments.’” Countries that join are subject to an evaluation process based on specific criteria. Journalists can find data, reports, sources, and warnings regarding the global industry on its platform.

Other useful reports and sources:

- The African Mining Vision is a continental policy adopted in 2009 by the African Union to help countries revise their mining policies to maximize benefits.

- Some regions of Africa have adopted codes and guidelines on the exploitation of extractive resources. In West Africa, for example, 15 countries adopted the ECOWAS Mining Directive in 2009. Eight countries of another important economic regional community in West Africa, UEMOA, have adopted a Mining Code. In Central Africa, the Community Mining Code is still at the draft stage.

- Read the existing laws at the national level: all extractive resource-producing countries have regulatory codes on relevant areas such as mining, oil, gas, environment, taxation, and customs. Also check the enforcement text of laws governing resource exploitation.

- Look for periodic financial publications or annual reports by extractive companies on their websites and on their affiliated stock exchanges.

- Publicly listed companies need to file reports with stock exchanges and regulatory agencies where they are registered. Often they are required to disclose new operations, lawsuits, and foreign activity.

- Reports from international NGOs can be invaluable. The African Tax Administration Forum has a database on the extractive sector by country. See also the Tax Justice Network Africa, Global Financial Integrity, OECD Global Forum on Transparency and Exchange of Information for Tax Purposes, Publish What You Pay, NRGI, and OXFAM.

- Check publications from national authorities, such as official government reports, statistics management services, mining contracts, parliamentary inquiries, and social and environmental assessments.

Case Studies

Gold Export Fraud, L’Economiste du Faso (2016)

This investigation by the newspaper L’Economiste du Faso revealed that 15 to 30 tons of artisanally produced gold were smuggled out of Burkina Faso each year, nearly equal to the nation’s legal industrial production of the precious metal in 2015 (36 tons). This widespread fraud represented a loss of revenue equivalent to US$500 million over 10 years.

Senegal Scandal, BBC (2019)

The BBC uncovered highly suspicious payments around oil contracts in Senegal. Image: Screenshot, BBC Afrique

This investigation found that a Romanian businessman obtained two generous oil and gas contracts totaling US$10 billion from the government of Senegal, even though he had no previous experience in the sector. Documents obtained by BBC Panorama and Africa Eye also revealed that the businessman’s company paid or promised “suspicious payments” of several million dollars to the brother of the president of Senegal. The journalists also consulted the mining contract to understand the discrepancies.

Nigerian Mining, Business Day (2022)

The Nigerian daily newspaper Business Day revealed the widespread practice of requiring applicants to pay bribes to obtain mining permits. Corruption had moved to the mining sites where billions of dollars that should be paid in the form of taxes, fees and royalties to the Treasury disappear. Overall, estimates are that Nigeria lost over US$5 billion to illegal gold smuggling between 2012 and 2018. The investigation used open data and interviews with public officials.

DRC Dealings, Jeune Afrique (2022)

The pan African magazine Jeune Afrique published a series looking into the networks of a powerful oil and mining dealer, an Israeli billionaire who “amassed his fortune through hundreds of millions of dollars’ worth of opaque and corrupt mining and oil deals” in the Democratic Republic of Congo (DRC), according to the US Treasury Department. This mining mogul allegedly acquired mineral and oil licenses at knock-down prices from the government, then sold them to international partners and back to the DRC.

South Africa Bribes, Swissinfo (2021)

This investigation alleged that Swiss and French companies are implicated in a vast bribery network in the African oil industry. The story reported on a secret sale of 10 million barrels of oil from South Africa’s national reserves by a state-owned strategic fuel fund. The value of the transaction was US$281 million, and it took place without any public solicitation of the deal. According to the story, the head of the fuel fund received bribes to facilitate the oil transactions. The journalist used court records and interviewed staff at anti-corruption NGOs.

Table of Contents | Introduction | Chapter 1 | Chapter 2 | Chapter 3 | Chapter 4 | Chapter 6 | Chapter 7 | Chapter 8 | Chapter 9

Additional Resources

GIJN Resource Guide to Covering the Extractive Industries

Reporting on Oil, Gas, and Murky Deals? There’s a Guide to Help with That

How They Did It: Uncovering a Vast Network of Illegal Mining

Elie Kabore is an investigative journalist in Burkina Faso. He has 17 years of experience in investigative journalism and is Director of Publication of the online newspaper Mines Actu Burkina, specializing in the mining sector. The author of several investigations on corruption, money laundering and illicit finance, Kabore is a trainer for the Norbert Zongo Unit for Investigative Journalism in West Africa (CENOZO).

Elie Kabore is an investigative journalist in Burkina Faso. He has 17 years of experience in investigative journalism and is Director of Publication of the online newspaper Mines Actu Burkina, specializing in the mining sector. The author of several investigations on corruption, money laundering and illicit finance, Kabore is a trainer for the Norbert Zongo Unit for Investigative Journalism in West Africa (CENOZO).