Illustration: Dominique Mwankumi pour GIJN

Guide to Investigating Organized Crime in Africa: Chapter 8 — Kleptocracies

Read this article in

Guide Resource

Guide to Investigating Organized Crime in Africa

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa — Introduction

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 1 — Environmental Crimes

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 2 — Terrorist and Militia Groups

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 3 — Crimes on the Oceans

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 4 — Arms Trafficking

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 5 — Natural Resources Theft

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 6 — Drug Trafficking

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 7 — Financial Crimes

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 8 — Kleptocracies

Chapter Guide Resource

Guide to Investigating Organized Crime in Africa: Chapter 9 — Other Crimes

Kleptocracy is government by theft. The Cambridge English Dictionary defines it as “a society whose leaders make themselves rich and powerful by stealing from the rest of the people.” It is a form of theft compatible with any system of governance — whether an electoral democracy or dictatorship. In its full expression, as seen across so much of Africa, kleptocracy is not simply about misappropriating money and power for enrichment. It is also the use of that power for control, repression, and the normalized punishment of dissidents.

From Angola’s elites wiring hundreds of millions out of the country to Eswatini’s monarch moving billions in public money into his personal trust fund, political leaders in Africa have frequently used the powers of their office to enrich themselves, often through misappropriation, bribery, and fraud. Across Africa, kleptocracy developed in post-colonial economies that went through a process of transition but not transformation. It is executed hand-in-hand with the offshoring of public and official monies through global service providers such as lawyers, accountants, and bankers. These kleptocratic regimes often exist in tandem with the sovereign state they are intended to govern.

This does not mean the government itself is displaced, but rather, hollowed out and repurposed with power vested in a parallel network of individuals. In practice, these people act like facilitators for organized crime and predatory corporate actors who raid and ruin economies. This may involve misappropriation of existing public resources, assets, and funds or it may include debt, loans, and agreements that traffic in these resources at a future date.

Contrary to mafia and terrorist-leaning states, authoritarian or one-party regimes that double as kleptocracies do not operate in the shadows. Their criminality is instead openly presented as politics in action by those ruling over the societies they ostensibly govern. Yet it’s important to recognize that kleptocratic rulers are not all-powerful. They are dependent on service providers below them, such as lawyers and bankers, and they are also responsive to what are, effectively, their bosses or shareholders, people like the drug kingpins or oil companies who provide them capital or other support. In these countries, corruption is factored in as a cost of doing business and can be so heavily institutionalized that it is no longer viewed as improper or illegal.

In many African countries, kleptocracy is cloaked in a narrative of liberation and “economic transformation” that diverts public funds (such as irregular spending or siphoned resources) and repurposes them. Control is maintained by using investments in public goods and services as bargaining chips while financing a militaristic force to enforce repression and isolate any dissident voices, including journalists.

Perhaps the most powerful opposition to kleptocrats is a robust, free, and independent press. For this reason, kleptocratic regimes rely upon a mix of legislative and judicial capture, state surveillance, and physical or legal actions to counter accountability journalism.

How It Works

The offshore infrastructure used to siphon billions from African nations developed in tandem with the development of kleptocratic networks. The demand-side financial services were eagerly courted by global — often offshore — branches of ostensibly legitimate onshore law firms, accountants, lobbyists and banks. This illicit supply chain confers a veneer of legitimacy for people or companies that are owners of capital, regardless of the origin. In return, these downstream accomplices enjoy lucrative clients who may be in power for decades.

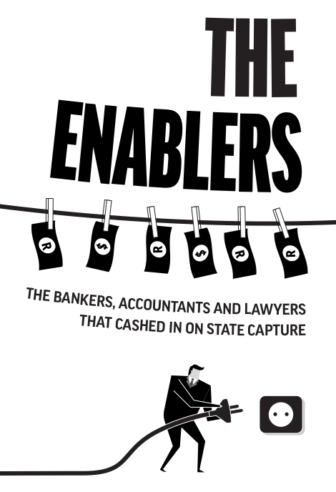

Investigations like The Enablers, by the South African NGO Open Secrets, detail how a network of banks and lawyers aid in the siphoning of massive amounts of money from the continent. Image: Screenshot, Open Secrets

At times, this external network of corruption becomes interwoven into the state itself. This can even be done through contracts, where a corrupt government outsources its own responsibilities to the private sector it was intended to regulate. So-called politically exposed persons (PEPs) are key players in this sector and they often deploy their political capital to shield foreign companies or partners from public scrutiny or local accountability.

In southern Africa, for example, the banner of “black economic empowerment” is often a ruse in which PEPs act as a conduit for the misallocation of funds or resources to benefit foreign investors. The South African NGO Open Secrets, through investigative series like The Enablers, revealed how both local and international banks worked with PEP-linked kleptocrats to siphon hundreds of millions from the South African government.

While Western countries, on the one hand, tout the ideals of public transparency and financial accountability, their economic and security interests often encourage the existence of long-term stable partners, which notably can include corrupt dictators where oil, gas, or other critical minerals are in play. In Angola, for instance, public debate is exclusively restricted to elites in that country’s dominant political party. Similar concentrations of economic and political power can be seen in the ruling families and strongmen in charge across francophone Africa and the Maghreb. But kleptocracies are not limited to autocracies or dictatorships. Electoral democracies, especially those that have been ruled by one dominant party since the end of colonialism, also struggle with entrenched corruption and the absence of institutional capacity and rights.

Tips and Tools

Identifying a kleptocratic state: Look for states that are characterized by a single dominant party rule or authoritarian leaders; have high military expenditure or military budgets as a percentage of GDP; single-commodity economies based around natural resource industries; exhibit significant foreign direct investment inflow and outflow unrelated to real economic activity; conceal state-owned entities, their subsidiaries or affiliates, and related activities; have commercialized their sovereignty as secrecy jurisdictions; contract large debts, especially private debts or bonds with non-public terms or high interest; and those plagued by very high inequality rates.

Tiny Equatorial Guinea has a relatively large GDP, but most of that capital is extracted by global oil companies. Image: Shutterstock

These states also frequently have healthy GDPs but a poor citizenry. For example, Equatorial Guinea, has a GDP of US$12.5 billion for a population of just 1.5 million people. But GDP tells half of the story, since the country’s vast oil reserves are mostly extracted by international oil giants such as Chevron. If you look up Equatorial Guinea’s Gini coefficient — which measures the difference between income earners across society — you’ll find that it suffers from some of the worst inequality in the world. Of the top ten most unequal countries in the world, eight are African. Included in that list are Botswana, Mozambique, Namibia, and South Africa — relatively rich economies that have been controlled for decades by one dominant political party, which have a legacy of corruption, theft of state resources, and use of liberation legacies as their basis for power.

Following the paper trail: For researchers to identify the origin of wealth, the process through which it is offshored, the subversion of political and legal accountability within the country, and the obstruction of international accountability through the laundering, they must study their subjects’ mentality. Leaders of former colonies such as Angola and Gabon, for example, often reproduce colonial tendencies by siphoning assets to Portugal and France. Even where corrupt politicians, predatory companies, or criminal cartels seek to disrupt a pattern or make it more efficient, they inevitably create new patterns. Keep in mind that while law enforcement is limited to investigating what violates the existing laws of a country, journalists should also examine what is against the purpose of the law or where certain countries, such as using offshore secrecy jurisdictions.

Tracing persons of interest: When trying to understand a kleptocrat’s sources of wealth, one of the first things to investigate is any corporate interest they and their factions may have. This scrutiny should include associates such as judges, ministers, and state-owned entity officials who are integral to the decision-making process. But it may also involve lower-level persons such as customs officials and tax inspectors. Every position has its own role and benefits. Follow any news, social media posts, or websites about the person of interest.

Verifying details such as video, images, and faces using publicly accessible databases and tools: From identifying who uses certain numbers or emails, to extracting metadata from images and videos, verification is an important step. Free systems like Pimeye, Truecaller, Pipl, LinkedIn, ExifPurge, Watools, and others are helpful in finding or verifying information on persons of interest.

Identifying corporate structures: Research ownership, management, and company assets via databases. This often requires scouring public data (including business registries, court records, official gazettes, databases, and leaks). Research the company’s website, prospectuses, investor relations pages, and annual reports.

Researching databases: Court records are a good start. SAFLII provides coverage of more than two dozen African countries and includes tax and high court rulings as well as national parliamentary records. Open source databases such as Open Corporates are available to search companies and officers from around the world. Commercial databases such as Sayari or Orbis can be used to trace the corporate interests of individuals, limited activities of each company, countries of operation, as well as details of linked or associated companies. Other paid services such as Dow Jones Factiva also provide information on sanctioned individuals and high-risk third parties.

Searching company registers: The OCCRP Aleph houses court, tax, corporate, property, and contractual data related to individuals worldwide. Journalists can also file research requests for harder-to-access info. ICIJ Offshore Leaks offers a similar series of datasets based on mass leaks of offshore holdings. Open Sanctions offers comprehensive and open source coverage of PEPs, sanctioned individuals, warrants, and conflicts of interest for more than 200,000 people across over 50 datasets. Unlike automated sources, Open Sanctions removes duplicates and updates the data. LexisNexis also includes data on sanctions and financial crimes, and tracks ongoing conflicts.

Tracing financial stagecraft: It’s critical to understand how wealth — such as property, cash, and companies — is targeted, siphoned, and laundered, especially where it is offshored. Though cash in a suitcase isn’t as common anymore, it still happens with large Western financial institutions not asking questions about the origin of the money.

Generally, offshoring relies on the skills of service providers who create multiple legal and jurisdictional layers to hide information from “home” country governments.

To follow the kleptocratic trail, begin with a piece of evidence, such as a company name, invoice, vessel, or location. Ask basic questions as if you are searching for the weakest link in your own investigation rather than the strongest:

- What is the purpose, and motive, of the publicly disclosed data or behind leaked data?

- In which country does it operate and why?

- What are the names of linked companies?

- Where are the linked companies incorporated and who are the beneficial owners or proxies?

- What is the relationship between the parent company and the affiliated or subsidiary entities?

- What taxes are paid? Are profits and losses recorded, and if so, where and why?

- Where are assets held? What type of assets? What is the origin, value, legal form and substance of resources and assets? Are there examples, tangible or intangible?

- What is the company’s financial infrastructure? Are there loans or investments, and if so, on what terms? (Thin capitalization usually indicates high interest rate, for instance.)

- What are the legal vehicles and “flags” or nationalities attached to assets such as vessels and equity?

- What are the shareholder forms and jurisdictions?

- Where are employees, if any, based?

- Does the declared purpose of the activities match revenue, debts, profits, and other performance?

- Are there any litigation issues globally that could yield more information? Lawsuits for example, can offer investigators access to troves of documents thanks to disclosure rules in the country where they are filed.

- What is the reality of the public company versus the perception if listed on a stock exchange or the private company in terms of net book and share value?

- What transactions, mergers, and partnerships has the company been involved with and why?

By understanding the taxonomy of the companies connected to PEPs and branching out using visuals or spreadsheets by timeline, country, activity, and value, it is possible to get a sense of a kleptocrat’s playbook.

Understand how corruption is facilitated by outside countries: Most of the world’s secrecy jurisdictions are ranked as countries free of corruption even though they still facilitate it; some examples are the Netherlands, Switzerland, Singapore, Luxembourg, and even Mauritius. (See Transparency International’s chart mapping financial secrecy and corruption perceptions of various countries below.) This is due to a misconception of what constitutes corruption as a process and in practice. Global definitions are usually limited to ‘demand-side’ factors such as corrupt officials in power rather than the governments or systems that enable them. By quoting false metrics, journalists may perpetuate the problem rather than help unravel the fault lines.

Collaboration: Through collaboration, journalists and researchers can jump national borders to find the evidence they’re looking for. In contrast, law enforcement is often locked within national boundaries and must seek cooperation from other nations — which often does not come. The absence of an international anti-corruption court means that investigative journalism, whistleblowers, and broader civil society networks are sometimes the only means to expose kleptocrats.

Look for media hubs that specialize in certain coverage: Relevant spaces to keep track of kleptocracy may include a probing eye on how deals are done, laws are made (or unmade), and whether the corrupt are held to account. One of the most important publications on the continent, Nigeria’s Premium Times, has a section called Parliament Watch that publishes features, investigations, and news about bills, budgets, and misappropriation. Led by veteran editor Dapo Olorunyomi, the site publishes stories every few days. Oxpeckers, a southern African environmental hub, performs a similar role combining investigative reporting on wildlife trafficking with data analysis and geo-mapping.

Tracing assets: Look for both monetary assets — such as stocks and bonds, and non-monetary assets — such as properties, art, and antiquities, as well as the toys of the jetset. Planes and yachts must be given unique identifying codes, registered to a particular country, and owned by a company or a person.

Open source databases such as Equasis are particularly useful in tracing marine vessels, including history of location and ownership. Marine Traffic and Vessel Finder also assist in identifying jurisdictions where marine vessels are registered, potential owners, and locations. For planes, platforms such as FlightRadar24, Flight Aware, and Icarus offer valuable identifying info on planes, including location, ownership history, and country of registration. LAAS International is another potential resource to trace corporate jets in particular. Further assistance can be found using GIJN’s Planespotting Guide. Similar sites may be found for property, art, and other assets.

However, there are a number of challenges in tracing these types of assets, including the use of jurisdictions that specialize in maritime and aviation secrecy. A plane or vessel’s own tracking devices may be turned off in transit, making the location temporarily or permanently “dark.” Marine vessels registered in nations such as Panama, Liberia, and the Marshall Islands, for example, are very difficult to trace as these “flags of convenience” offer secrecy for everything from oil rigs to cruise liners to pleasure boats. For instance, most of Nigeria’s oil rigs are registered in maritime tax havens with little to no labor, environmental, or financial regulations. These rigs can be registered for just US$15,000 per year. Using community forums like shipspotting or PPrune Forum, you can listen in on the chatter from ship captains, pilots, and other industry veterans and enthusiasts. Tracking the IMO, a unique seven-digit number used to mark a vessel from creation to demolition, may help identify the owners.

Protect yourself from lawsuits: Many African media lack access to lawyers and liability insurance. Protect yourself. A common consequence of investigations into kleptocracy is a strong reaction from those wealthy enough to legally squash an accurate story. Oligarchs and kleptocrats may claim they never received the so-called “no surprises” email seeking comment — or that they didn’t receive it with enough time to respond before publication. Using tools such as Streak for email can allow journalists to have an independent record of when the email was opened, the device used, and even how many times it was forwarded. Similarly, sending questions by WhatsApp and LinkedIn also confirms received messages. For more on this read GIJN’s Guide to Avoiding Lawsuits and this story on Tips for the ‘No Surprises’ Letter.

Case Studies

Unraveling the kleptocrat economy can be a painstakingly long process. It does not necessarily require the best resources, the most veteran journalists, or the biggest scandals. Kleptocracies are rarely unraveled in a single story. Instead, journalists must be willing to slowly chip away at a seemingly impenetrable wall of secrecy, slowly bringing the truth to light.

Fishnet Scandal, The Namibian (2019)

This exposé of the Fishrot scandal laid bare the corruption at the heart of Namibia’s dominant party and its most senior officials. It was a criminal scheme constructed around the country’s blue gold: fish. With their blockbuster series, Shinovene Immanuel and his team prompted multiple ministers to resign, and several prosecutions for corruption to move forward.

State-owned agencies in Africa, like the Sonangol oil conglomerate (based in Luanda, Angola), can be ripe targets for exploitation by kleptocrats. Image: Shutterstock

Sonangol on the Brink, Maka Angola (2017)

A great investigation might also come from a less traditional outlet, like a blog, where pieces of the puzzle are constantly being put together in real-time. Since its creation, Maka Angola has been the primary source of investigations from and about Angola. Run by the award-winning investigative journalist Rafael Marquez, the site has meticulously probed corruption involving banking, debt, and mineral resources that invariably points to a small inner circle — known as the futungo — controlling the economy. In 2019, Marquez also led an investigation, published by Forbes, about how the daughter of the country’s former dictator banked US$3 billion.

Misspent COVID Funds, ZAM Media (2021)

Another story that stands out was a project by ZAM Media, written by renowned Malian journalist David Dembele. He investigated how COVID-19 funds provided by development partners were misused. Dembele, who is also editor-in-chief of Depeche Du Mali, exposed how hundreds of millions allocated for the crisis had been diverted by the government to security, electoral campaigns, and other unrelated activities. The key source of information for this story was a public document. The story is a reminder that a crisis creates good financial opportunities for bad actors.

Table of Contents | Introduction | Chapter 1 | Chapter 2 | Chapter 3 | Chapter 4 | Chapter 5 | Chapter 6 | Chapter 7 | Chapter 9

Khadija Sharife joined the Organized Crime and Corruption Reporting Project in 2017, where she is a senior global investigator. She is former director of the Platform for the Protection of Whistleblowers, has a masters in law, and has done investigations into illegal logging in Madagascar, corruption in Angola, and arms trafficking in Cote d’Ivoire. She is a 2021 Yale Poynter Fellow in Journalism.

Khadija Sharife joined the Organized Crime and Corruption Reporting Project in 2017, where she is a senior global investigator. She is former director of the Platform for the Protection of Whistleblowers, has a masters in law, and has done investigations into illegal logging in Madagascar, corruption in Angola, and arms trafficking in Cote d’Ivoire. She is a 2021 Yale Poynter Fellow in Journalism.